Hsmb Advisory Llc Fundamentals Explained

Table of ContentsAll about Hsmb Advisory LlcThe Main Principles Of Hsmb Advisory Llc Hsmb Advisory Llc Things To Know Before You BuyOur Hsmb Advisory Llc Diaries

Life insurance is especially vital if your family is reliant on your wage. Market specialists recommend a plan that pays out 10 times your annual earnings. These may consist of home mortgage payments, outstanding finances, credit score card debt, taxes, child care, and future university expenses.Bureau of Labor Statistics, both partners functioned and brought in earnings in 48. They would certainly be most likely to experience monetary hardship as an outcome of one of their wage income earners' deaths., or exclusive insurance coverage you get for on your own and your family by getting in touch with health and wellness insurance coverage business directly or going with a health and wellness insurance coverage representative.

2% of the American population lacked insurance coverage in 2021, the Centers for Illness Control (CDC) reported in its National Center for Wellness Data. Greater than 60% obtained their insurance coverage with a company or in the exclusive insurance industry while the remainder were covered by government-subsidized programs consisting of Medicare and Medicaid, experts' benefits programs, and the government marketplace established under the Affordable Care Act.

Hsmb Advisory Llc Can Be Fun For Anyone

If your income is low, you might be just one of the 80 million Americans that are qualified for Medicaid. If your earnings is moderate but doesn't stretch to insurance policy protection, you might be qualified for subsidized insurance coverage under the government Affordable Treatment Act. The finest and least costly choice for salaried staff members is usually participating in your company's insurance policy program if your employer has one.

According to the Social Protection Management, one in 4 workers entering the labor force will certainly end up being impaired before they get to the age of retirement. While wellness insurance coverage pays for a hospital stay and medical costs, you are often strained with all of the expenditures that your paycheck had covered.

Many policies pay 40% to 70% of your earnings. The expense of handicap insurance coverage is based on lots of elements, including age, way of living, and health.

Several strategies need a three-month waiting duration before the protection kicks in, give an optimum of 3 years' worth of coverage, and have considerable plan exclusions. Right here are your options when buying auto insurance: Obligation protection: Pays for property damage and injuries you trigger to others if you're at mistake for a crash and additionally covers lawsuits costs and judgments or settlements if you're filed a claim against because of an auto crash.

Comprehensive insurance coverage covers burglary and damage to your auto as a result of floodings, hail, fire, vandalism, dropping items, and pet strikes. When you finance your automobile or rent a car, this sort of insurance coverage is mandatory. Uninsured/underinsured motorist (UM) coverage: If an uninsured or underinsured vehicle driver strikes your vehicle, this protection pays for you and your guest's medical expenses and might additionally make up lost revenue or make up for discomfort and suffering.

Company coverage is commonly the very best choice, however if that is unavailable, get quotes from several carriers as many offer discounts if you buy even more than one type of protection. (https://myanimelist.net/profile/hsmbadvisory)

Getting My Hsmb Advisory Llc To Work

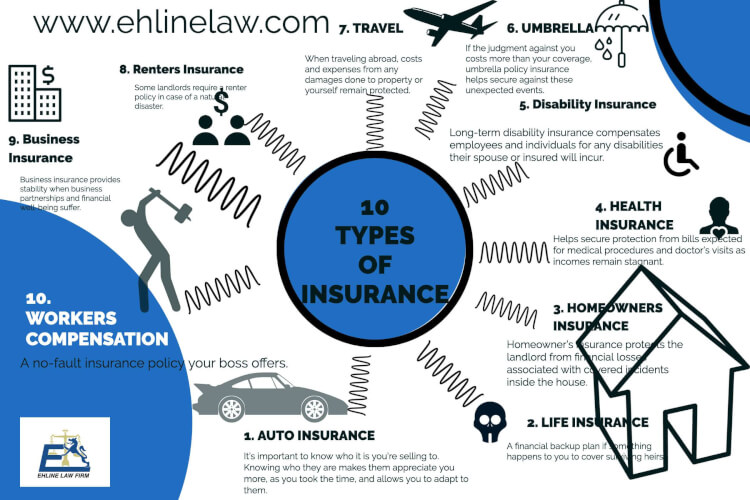

In between health insurance, life insurance policy, handicap, obligation, long-lasting, and even laptop insurance, the task of covering yourselfand believing concerning the endless possibilities of what can take place in lifecan feel overwhelming. Once you understand the basics and make certain you're sufficiently covered, insurance policy can enhance financial confidence and well-being. Right here are the most essential kinds of insurance you require and what they do, plus a couple pointers to stay clear of overinsuring.

Different states have various regulations, but you can anticipate medical insurance (which many individuals make it through their employer), automobile insurance policy (if you possess or drive an automobile), and homeowners insurance coverage (if you own property) to be on the checklist (https://www.viki.com/collections/3896580l). Obligatory sorts of insurance policy can change, so check out the most recent laws once in a while, specifically prior to you renew your policies